The current economic climate has left us all with uncertainties and worry. A steady stream of confounding economic indicators doesn’t help. Calling out the elephant in the room, a recent declarative statement from the World Bank stating that the global economy is on a “razor’s edge” and may fall into recession this year, almost confirms what is in everybody’s minds. How are companies and individuals coping in these trying times of belt-tightening, slowdown and layoffs? How are people and companies gearing up for the new year? Is it really as bad as we read in the media about the biggest companies, such as Amazon, Facebook, Google, Salesforce, Twilio doing layoffs?

The slump is more severely being felt by the B2B SaaS ecosystem. The (almost unexpected) bullish run that the 2020 pandemic delivered to the B2B SaaS ecosystem allowing for bloated projections and spending in equal measures is likely working counter-productive in the current times.

To assess the general outlook concerning the current economic environment and its impacts within the revenue generation purview of B2B SaaS companies, we decided to ask them directly. We ran a month-long survey asking some straight, hard-hitting questions with the intent to help each other make better sense of it all and stay strong.

The audience of this survey were sales and marketing practitioners from B2B SaaS companies, sharing with us their personal views and their experience with their companies’ response to tackle the current situation.

There’s no denying that B2B SaaS businesses are seeing real signs of economic contraction. Brute force methods that depend on infinity budgets no longer cut it. Nonetheless, the outlook is not all poignant, nor suggesting stagnant growth, but is more about creating a resilient and efficiency-driven system.

Let’s take a closer look at the GTM outlook as revealed by our survey, and the CRM data related corrective measures that companies are taking to introduce resilience (in the form of efficiency and reduced wastage) in their revenue acquisition and growth systems.

It is Time for Greater Precision and Targeting to Deliver the Same Results With Fewer Resources

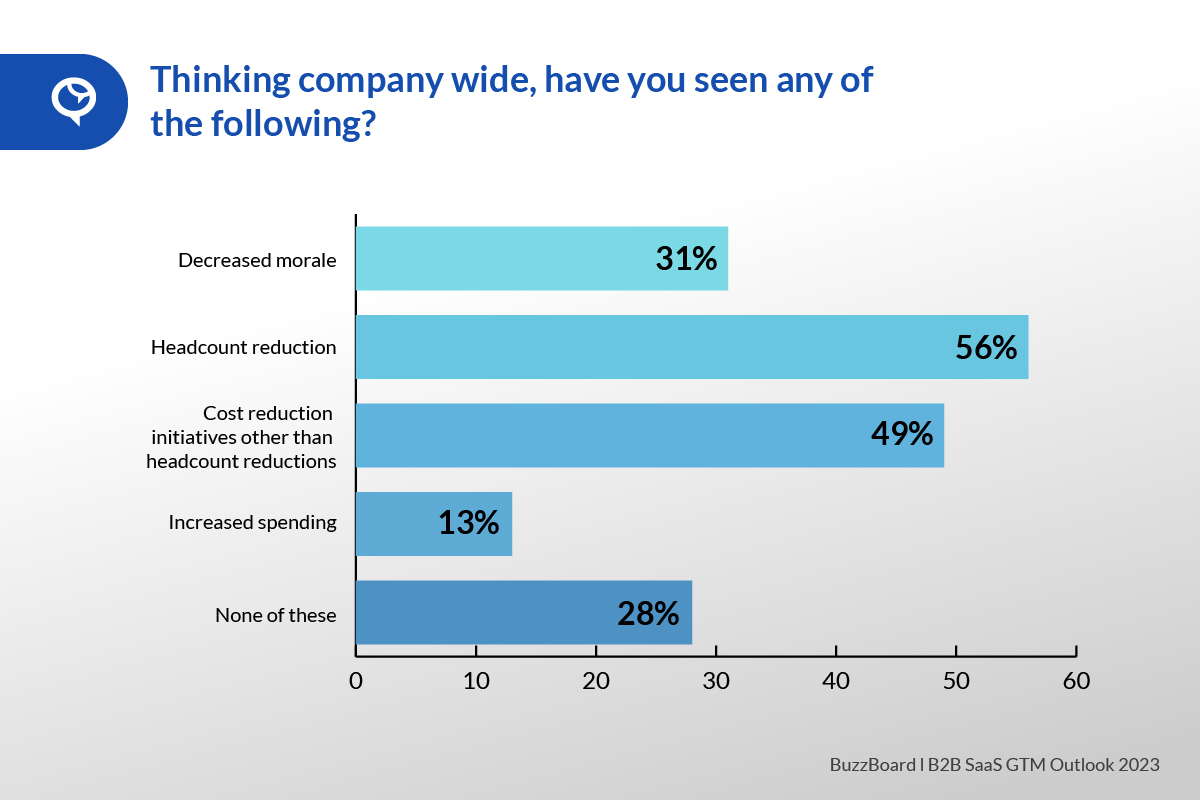

- Belt-tightening seems like a common response to the current economic situation. Companies are bringing in hiring freeze (15%), downsizing teams (56%), and reducing go-to-market expenses overall (49%).

-

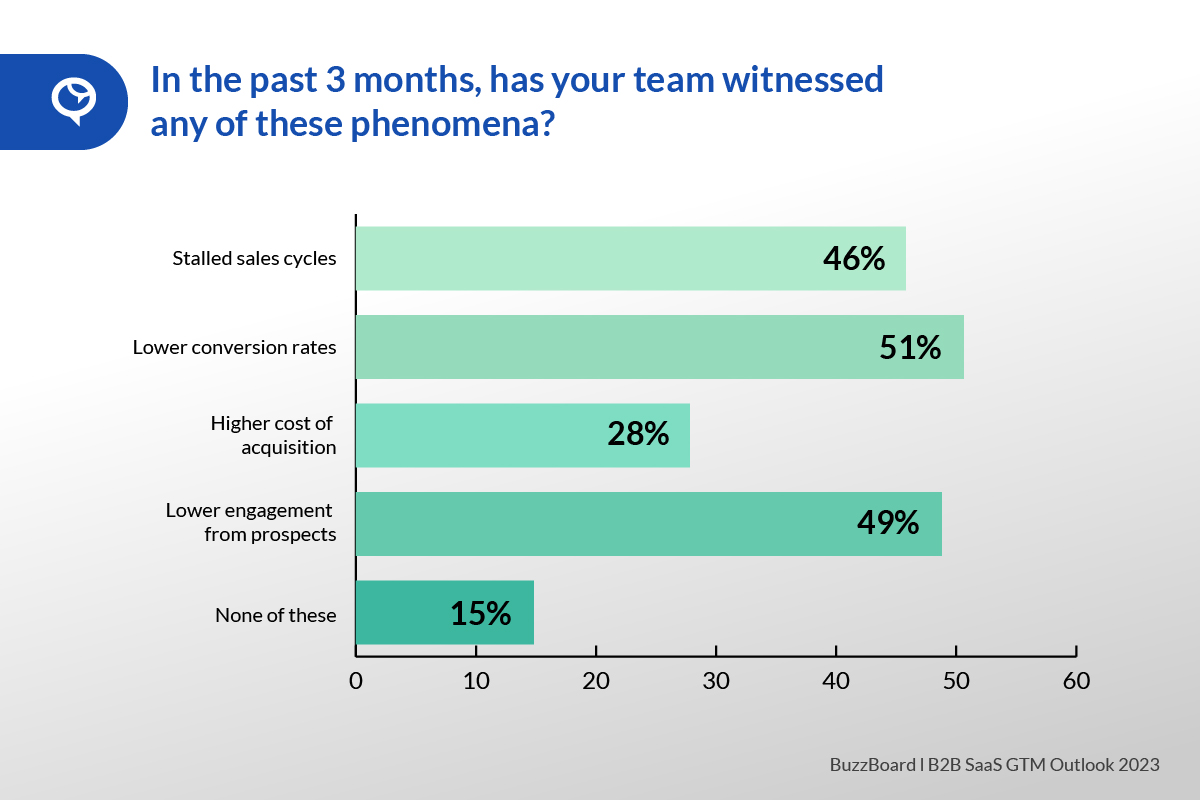

More than half of the respondents reported experiencing a lower conversion rate in the last 3 months (and the trend will likely continue through most of the current year), with only 15% of them seeing no negative impact on their GTM forecast for 2023.

-

- 46% even reported stalled sales cycles as a result of the economic contraction

-

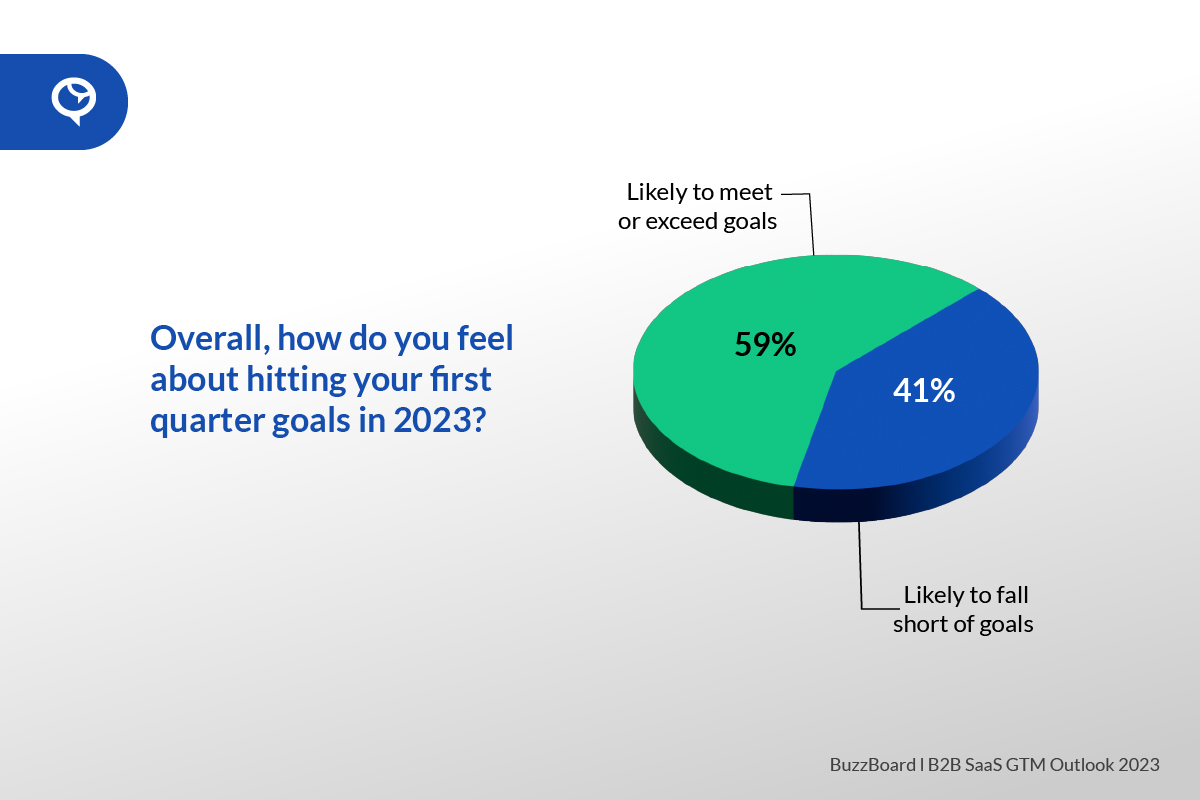

- While 2 out of every 3 respondents feel that it is getting harder to generate a pipeline in the current situation, 1/3rd of them believe they have not seen much change for their companies. However, with the right measures in place, revenue professionals continue to stay positive about meeting their 2023 goals with 59% believing they will be on target.

While there is a unanimous verdict on brute-force methods no longer cutting it, intentional, mindful selling will help teams attain quotas and close new businesses.

B2B SaaS Revenue Professionals are Split in their Personal Outlook for 2023

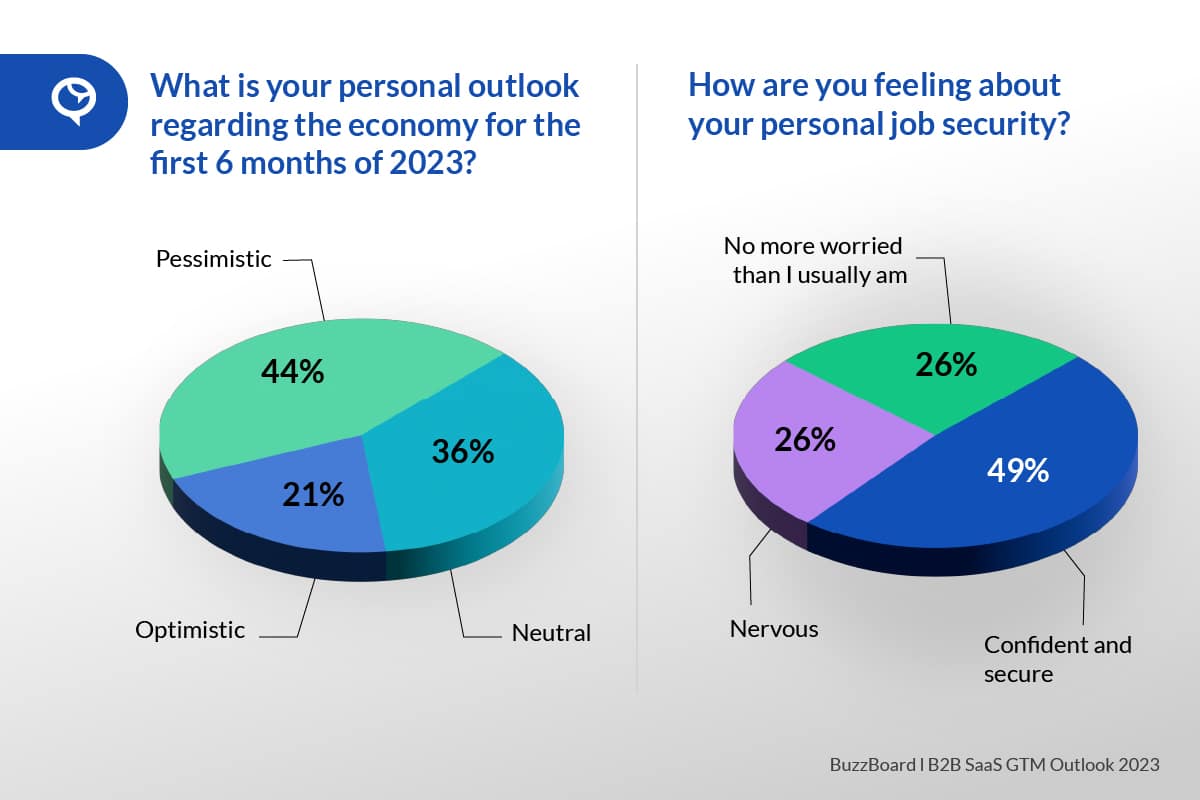

A quick sentiment analysis of respondents’ personal outlook regarding the economy for the first 6 months of 2023 reveals a split between negative and neutral outlook, while about 20% remain optimistic. The sentiment largely anchors on the challenging road ahead for sales and revenue acquisition going into 2023.

Interesting to note is that a majority of them continue to feel secure in their job. This reconfirms that the measures are mostly about pulling back on brute-force methods, and not so much about pessimism and slowing things down.

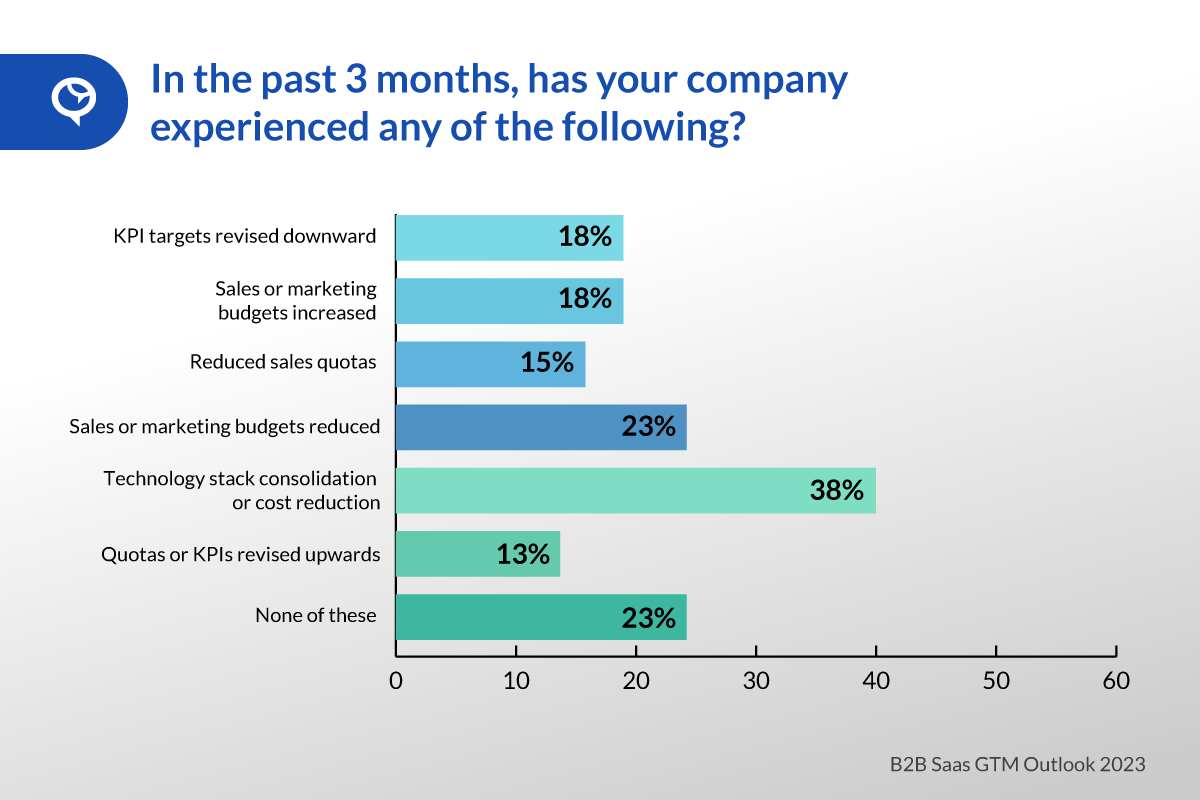

Corrective measures are in play across companies. While sales quotas and targets are being revised downwards in a few cases, the approach is largely about wringing in efficiency gains. Sales and marketing budgets are being reduced, companies are revisiting their tech spend and looking at ways to consolidate their technology stack to reduce expenses.

Tackling Economic Uncertainty with Efficient CRM Data Strategies

We are hearing more of our customers and prospects tell us that they want to take the “I feel” gut decisions out of their go-to-market motions. Nothing screams inefficiency louder than building a bloated top-of-funnel with irrelevant contacts (bought in bulk) for your sales to chase down, or trying to sell to accounts just because you have contact data for them. Instead, companies are now investing in their account records first to keep them focused on the richest target accounts—those most likely to close the fastest—shape and improve their prospecting database, and keep them on-target in the allocation of scarce resources.

This is the time to revisit your go-to-market architecture setup. The right data play can hugely impact how you can maintain strong KPIs with limited resources. An ‘account-first’ GTM approach that leads with account identification, classification, scoring, and prioritization makes better use of your resources and maximizes efficiency in your go-to market efforts.

With rich account data you can also segment your accounts by score to align go-to-market investment to resources. For example, you may decide to NOT invest resources in the lowest scoring quartile of your TAM. For the second-lowest quartile, you may, for example, limit yourself to email marketing, and reserve full-on account-based marketing programs for the top two quartiles.

Expand the capabilities of your CRM with rich account data to qualify and prioritize your prospecting database.

Contractions and consolidation need not carry a negative connotation. After all, in the modern age of ‘data economy’, it is, indeed, the right time for greater precision and targeting to deliver the same results with fewer resources!