In June, I wrote about pharmacies and the marketing opportunities that can be seen through the lens of “big data.” Following up on that analysis, the team at BuzzBoard ran another round of data, focused this time on the optometry industry.

In June, I wrote about pharmacies and the marketing opportunities that can be seen through the lens of “big data.” Following up on that analysis, the team at BuzzBoard ran another round of data, focused this time on the optometry industry.

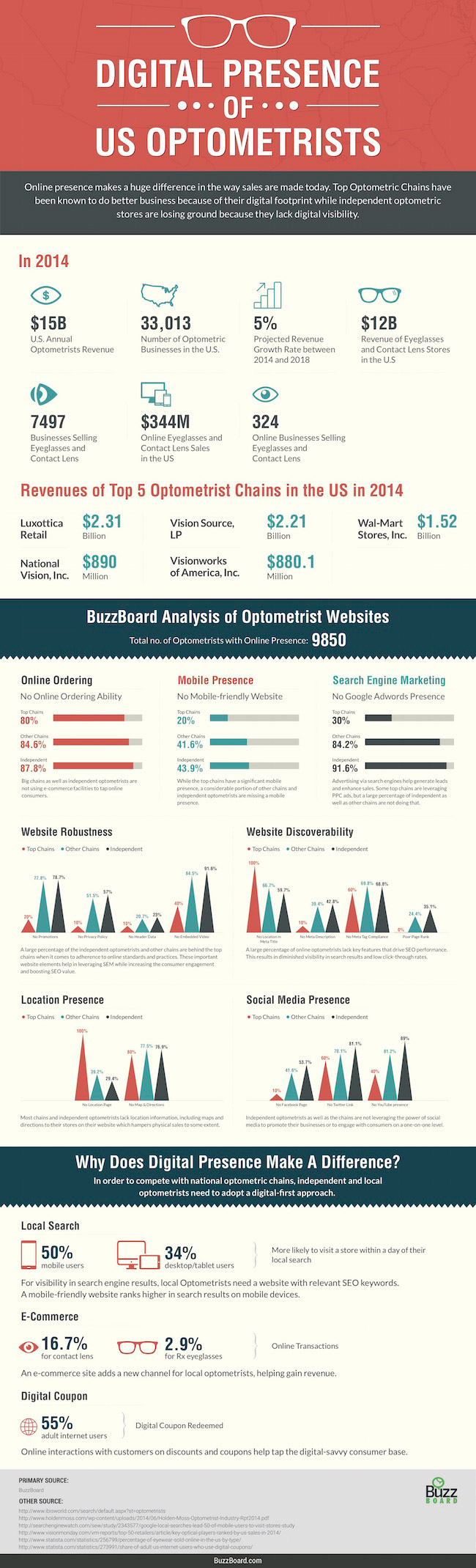

Looking at the world of local optometrists in the U.S., the BuzzBoard team found a number of very interesting facts. For instance, the industry numbers some 33,000 businesses and generates an estimated $15B in annual sales at an average of $450k per year. The industry is growing at 5% annually, but it’s, of course, under considerable pressure from the likes of Amazon, Warby Parker and 1-800-Contacts.

Like many businesses in consumer industries in the U.S. and around the world, there are really three tiers of players — the large global and national players, the regional chains, and the true independent stores. Even the small independent stores often find the need to open additional stores in adjacent communities to leverage the brand across a broader audience.

So here’s what I learned: even with the Amazons and Warby Parkers lurking, most large and small operations don’t yet offer their customers an online ordering capacity. According to the data, just 20% of the largest chains offer online ordering and that number drops to just 13% for local independent stores. For independent stores, it is logical that they’d want to use the local presence and in-store product knowledge to direct the business behavior.

Just 56% of independent stores offer a truly mobile experience. Now I can see that whether an independent store-owner chooses to offer online ordering is a valid tactical question, but it would seem outright foolhardy to ignore the vast movement to mobile devices and not offer a mobile-centric web presence.

Just like we found with the independent pharmacies, only 9% of the independent optometrists are leveraging the power and capacity of SEM. Not surprisingly, they face fierce competition from regional chains, 16% of which are using SEM. In order to stay competitive with the regional chains, it would probably behoove the independent store owner to consider testing the potential return on a smartly executed SEM campaign.

The data also indicated that most independent stores have not yet figured out that the consuming public is drawn to the videos. Just a handful of independent and regional chain operators are turning to video as a means of communicating with their consumers even in the face of facts that indicate video is often the preferred option of the consumer.

Some Eye-Opening Conclusions:

After all the data crunching, it is crystal clear that independent and local optometrists need to steer their approach to digital solutions to ensure that they are not dwarfed by the big chains. The visibility of these businesses should not be restricted to the web-only, but, rather extend to the mobile-centric population. By staging their presence on mobile devices, independent and local businesses can capture the attention of the users who prefer to visit the local stores based on their mobile search results.

In view of just 17% of the total industry-based online transactions, local optometrists have ample room to participate in the next-big e-commerce segment. What is even more eye-opening is the scope of leverage that a local independent optometrist can derive from the 55%, and growing U.S adult user base, who are on the lookout for redeemable digital coupons online.

It is up to local optometrists, to either clinch the mobile opportunity or risk getting buried under big competitors.